1.Why Incoterms Matter for B2B Buyers

In international trade, clarity is everything. When you place a bulk order with a manufacturer overseas, the last thing you want is confusion about who is responsible for shipping, insurance, customs clearance, or delivery costs. That’s where Incoterms (International Commercial Terms) come in.

Published by the International Chamber of Commerce (ICC), Incoterms provide a universal set of trade rules that define the responsibilities between buyers and sellers. They are widely used in contracts, invoices, and negotiations to avoid disputes.

For B2B buyers, understanding Incoterms 2020 is not just a matter of compliance—it’s about managing risks, controlling costs, and securing smoother supply chains. Whether you are sourcing from China, Europe, or other markets, the right Incoterm can make or break your deal.

This guide will help you understand what Incoterms are, the main categories of responsibility, and how to choose the best terms for your wholesale business.

2.What Are Incoterms 2020?

2.1 Definition and Purpose (ICC Rules)

Incoterms, short for International Commercial Terms, are a set of globally recognized trade rules published by the International Chamber of Commerce (ICC).

Their purpose is to:

- Define the responsibilities of buyers and sellers in international trade.

- Clarify who handles transport, insurance, export duties, and import clearance.

- Reduce misunderstandings and disputes by creating a common legal language for contracts.

For B2B buyers, using the correct Incoterm ensures cost transparency, minimizes risk, and helps build trustworthy supplier relationships.

2.2 Transport Mode Categories

Incoterms 2020 are divided into two groups based on the mode of transport:

All Transport Modes (7 terms)

CIP (Carriage and Insurance Paid To)

DPU (Delivered at Place Unloaded)

These terms apply to sea, air, rail, road, or combined transport.

Sea and Inland Waterway Transport Only (4 terms)

CIF (Cost, Insurance, and Freight)

These are used exclusively for bulk and containerized shipments by sea.

For buyers, recognizing the correct category is essential. For example, FOB is ideal for ocean freight, but not suitable for air or rail shipments.

2.3 Key Updates from Previous Versions

Incoterms are updated roughly every decade to reflect changes in global trade practices. The 2020 version introduced several important updates:

- DAT → DPU

The term “Delivered at Terminal (DAT)” was replaced with “Delivered at Place Unloaded (DPU)”.

This change makes it clear that the delivery location can be any place, not just a terminal, as long as the goods are unloaded.

- CIP Insurance Requirement

Under CIP (Carriage and Insurance Paid To), the seller must now provide higher insurance coverage (Institute Cargo Clauses A, all risks) compared to the previous standard.

This gives buyers stronger protection in case of damage or loss.

- FCA and Bills of Lading

In practice, many buyers using FCA (Free Carrier) wanted a Bill of Lading with an on-board notation to secure payment under a Letter of Credit.

Incoterms 2020 now allow sellers and buyers to agree that the seller will obtain this document from the carrier.

These updates reflect a growing need for flexibility, transparency, and risk management in modern supply chains.

3.Buyer Responsibilities and Risk Under Each Incoterm

When negotiating with suppliers, one of the most important considerations for B2B buyers is understanding who is responsible for transportation, insurance, and customs clearance. The choice of Incoterms directly affects cost allocation and risk transfer. A wrong decision could leave you paying unexpected charges or facing delays at customs.

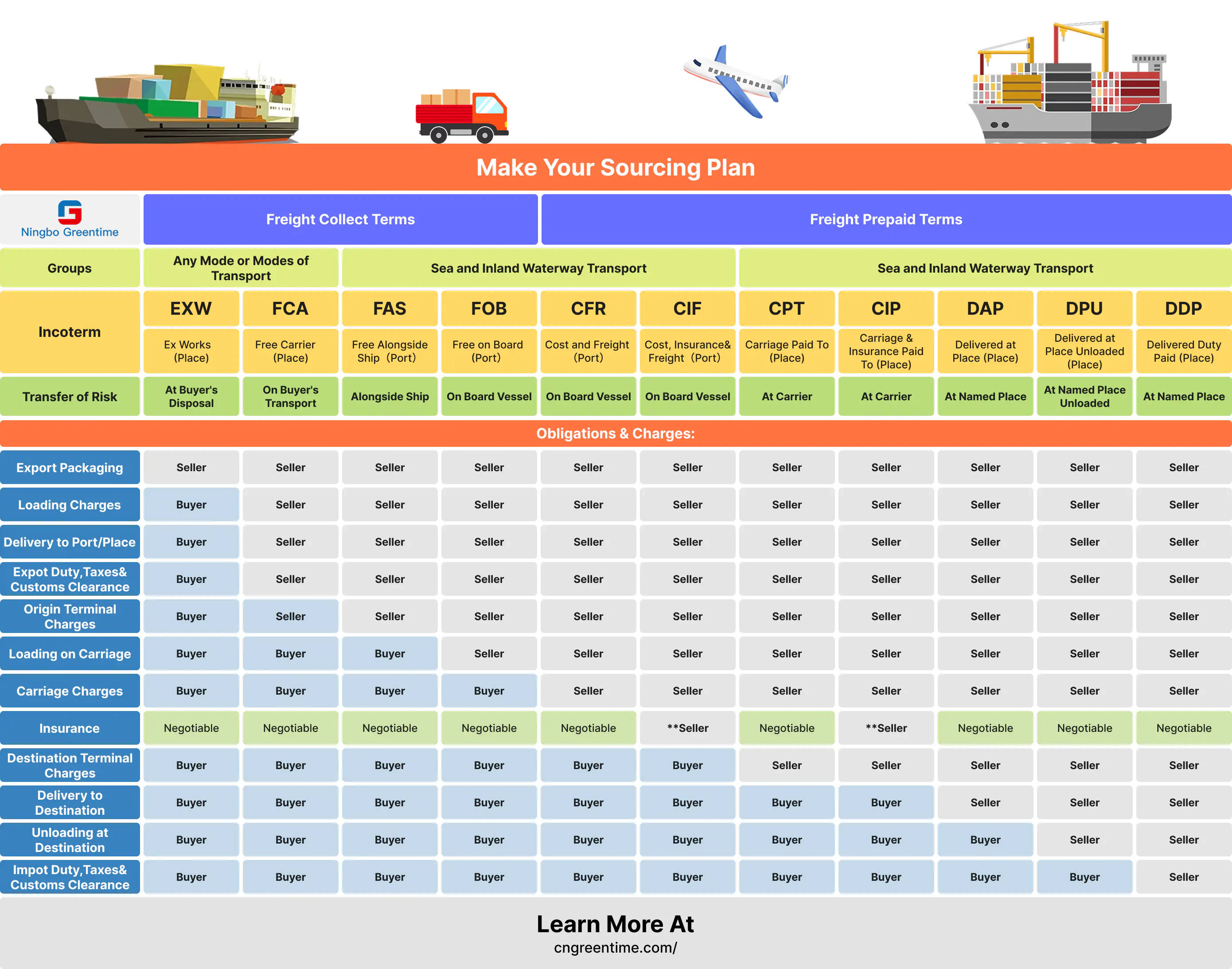

To give buyers a clear overview, the following table compares the most commonly used Incoterms 2020, highlighting buyer vs. seller responsibilities, risk transfer points, and practical implications.

Incoterms 2020 – Buyer Responsibilities & Risk Comparison

| Term | Buyer’s Responsibilities | Seller’s Responsibilities | Risk Transfer Point | Best Use Case | Buyer Pros & Cons |

| EXW – Ex Works | All costs: inland transport, export clearance, international freight, insurance, import clearance, duties | Make goods available at seller’s premises | At seller’s factory/warehouse | Buyers with strong logistics network | ✅ Lowest price; ❌ Maximum risk, hidden costs |

| FCA – Free Carrier | International freight, insurance, import clearance, duties | Export clearance, delivery to carrier at named place | When carrier receives the goods | Container shipments, letter of credit payments | ✅ More balanced than EXW; ❌ Buyer still covers main transport risks |

| FOB – Free on Board | Ocean freight, insurance, import clearance, duties | Export clearance, delivery to port, loading on vessel | Once goods are on board at port of shipment | Traditional sea freight, bulk cargo | ✅ Clear responsibilities; ❌ Risk passes early to buyer, not ideal for containers |

| CIF – Cost, Insurance & Freight | Import clearance, duties, destination charges | Export clearance, sea freight, basic insurance (Clause C) | Once goods are on board at port of shipment | Common for bulk ocean shipments | ✅ Transparent costs; ❌ Insurance may be insufficient |

| CIP – Carriage & Insurance Paid To | Import clearance, duties, destination handling | Export clearance, international freight, high-level insurance (Clause A) | When carrier receives goods | Multimodal transport, air freight | ✅ Higher insurance coverage; ❌ Buyer still handles destination risks |

| DAP – Delivered at Place | Import clearance, duties | Export clearance, delivery to buyer’s site (unloaded) | At named place of destination | Buyers unable to handle export but can manage import customs | ✅ Seller covers transport; ❌ Buyer must manage clearance |

| DPU – Delivered at Place Unloaded | Import clearance, duties | Export clearance, transport, unloading at destination | Once goods are unloaded at destination | When unloading facilities are required at buyer’s site | ✅ Seller handles unloading; ❌ Buyer still manages import clearance |

| DDP – Delivered Duty Paid | Only receive the goods | All: export & import clearance, transport, duties, taxes | At buyer’s named place | Door-to-door service, turnkey deliveries | ✅ Hassle-free for buyer; ❌ Higher hidden costs, seller adds markup |

As the table shows, Incoterms range from EXW (Ex Works), where the buyer assumes almost all responsibilities, to DDP (Delivered Duty Paid), where the seller handles nearly everything. Most transactions fall somewhere in between, such as FOB, CIF, or CIP, depending on the transport mode and negotiation leverage.

- EXW vs. DDP: The two extremes of responsibility—buyers should only choose EXW if they have a strong logistics network, while DDP is convenient but usually comes at a premium.

- FOB vs. CIF: Both are common for sea freight, but CIF includes freight and insurance, while FOB shifts risk earlier.

- CIP vs. CIF: CIP requires a higher level of insurance coverage, making it better for multimodal or air shipments.

- DAP vs. DPU: The only difference is whether the seller must unload the goods at destination.

Understanding these distinctions ensures that buyers can negotiate fairer contracts, avoid hidden costs, and reduce the risk of disputes.

4. How to Choose the Right Incoterm as a Buyer

Selecting the right Incoterm is not just a legal formality—it directly impacts your shipping costs, risk exposure, and supply chain efficiency. Here are four key factors buyers should consider:

4.1 Based on Transport Mode (Sea, Air, Multimodal)

Different Incoterms apply to different transport methods:

- Sea Freight: Use terms like FOB, CIF, CFR, or FAS. These are designed specifically for ocean shipments, often suitable for large, bulky, or containerized cargo.

- Air or Multimodal Transport: Choose from EXW, FCA, CPT, CIP, DAP, DPU, or DDP. These work better when goods are shipped by air, rail, or a combination of methods.

Rule of thumb: If your shipment involves mixed transport modes, always choose an “all modes” Incoterm for greater flexibility.

4.2 Based on Internal Capability (Customs Clearance, Logistics Partners)

Your internal resources and partnerships strongly affect which Incoterm is best:

- If you have strong logistics partners or a local office at origin, you may prefer EXW or FCA, giving you more control over shipping and costs.

- If you lack customs clearance expertise, consider terms like DAP or DDP, where the seller handles most formalities.

- If you want a balance, FOB or CIF are widely used, especially for buyers sourcing from China.

The more capability you have in logistics and compliance, the more responsibility you can safely take on.

4.3 Based on Product Type, Value, and Insurance Needs

Not all products should be shipped under the same Incoterm:

- High-value or fragile goods: Prefer CIP or CIF, since they include seller-provided insurance.

- Low-margin or bulk commodities: Buyers often choose FOB or EXW to negotiate better freight rates through their own carriers.

- Sensitive or time-critical goods: Consider DAP or DDP, where the seller arranges almost everything, minimizing potential delays.

Always weigh the value of goods vs. cost of insurance and risk exposure before deciding.

4.4 Matching Incoterms with Payment Methods (e.g., Letters of Credit)

Incoterms should also align with your payment terms:

- Letters of Credit (LCs) often require a Bill of Lading with on-board notation. This matches well with FOB or FCA (with added Bill of Lading agreement under Incoterms 2020).

- Open account or advance payments may work with DAP or DDP, since you want sellers to take maximum responsibility.

- Cash against documents (CAD) usually fits with CIF or CFR, where sellers can easily provide shipping documents.

Always confirm with your bank which Incoterms are acceptable under your payment method to avoid financing delays.

5. Key Contract Considerations for Buyers

When negotiating international purchase contracts, simply stating an Incoterm such as “FOB” or “CIF” is not sufficient. For B2B buyers, precision in contract wording is crucial to avoid misunderstandings, unexpected costs, or disputes. Incoterms 2020 provide a standardized framework, but their effectiveness depends on how they are applied in your contract. Below are four critical considerations every buyer should follow.

5.1 Always Specify “Incoterms® 2020”

Why it matters:Incoterms have been updated over the years (2000, 2010, 2020). Using an outdated or unspecified version can lead to disputes about which rules govern delivery, risk transfer, and responsibilities.

Practical advice for buyers:Always write the full clause in your contract

Example: FOB Shanghai Port, Incoterms® 2020

Including the official version ensures both parties follow the latest ICC rules and provides legal clarity.

This also helps avoid rejection of documents or delays in trade finance transactions, such as Letters of Credit (LCs).

5.2 Naming the Exact Place/Port

Why it matters:Vague delivery locations, such as “FOB China” or “CIF Europe,” can create confusion over risk transfer points, inland transportation costs, and unloading responsibilities. Ambiguity often leads to hidden charges or disputes.

Practical advice for buyers:Specify the exact port, airport, or delivery address.

Examples:

CIF Hamburg Port, Incoterms® 2020

DAP 45 Industrial Park, Los Angeles, USA, Incoterms® 2020

Be as precise as possible—this ensures the seller delivers exactly where agreed and helps avoid additional local transport or handling fees.

5.3 Defining Customs Clearance and Insurance Responsibilities

Why it matters:While Incoterms clarify risk transfer and delivery obligations, they may not fully define who handles customs clearance or the scope of insurance coverage. Overlooking these details can result in shipment delays, extra charges, or inadequate insurance protection.

Practical advice for buyers:Explicitly state who handles export licenses, import permits, and customs duties.

For insurance, do not assume that CIF or CIP automatically provides sufficient coverage. Specify the insurance type:

- ICC (C) – minimum coverage

- ICC (A) – all-risk coverage

Request copies of insurance policies and customs documents in advance to verify compliance.

Example:

“Seller shall arrange CIP transport with ICC (A) insurance to Hamburg Port. Buyer responsible for import customs clearance and duties.”

5.4 Ensuring Documents Meet Banking and Compliance Requirements

Why it matters:In international trade, documents are as critical as the goods themselves. Incorrect or missing documents can delay payment, cause LC disputes, or block customs clearance.

Practical advice for buyers:

Align Incoterms with your payment method:

- Letters of Credit (LCs): FOB or FCA with an on-board Bill of Lading is usually required.

- Open account or advance payments: DAP or DDP may be more convenient.

Ensure the seller provides all necessary documents:

- Commercial invoice

- Packing list

- Bill of Lading or Air Waybill

- Insurance certificate (if applicable)

- Certificate of origin and compliance certifications

For regulated goods (electronics, chemicals, food), confirm all required regulatory certificates are included.

Example:

“Seller shall provide commercial invoice, packing list, Bill of Lading, insurance certificate (CIP – ICC A), and certificate of origin at least 3 days before shipment departure.”

6. Common Mistakes Buyers Should Avoid

When working with international suppliers, even experienced B2B buyers sometimes misapply Incoterms. These errors can lead to unexpected costs, disputes with suppliers, and shipment delays. Below are the most common pitfalls, with practical advice on how to avoid them.

6.1 Treating Incoterms as Complete Contracts

Mistake: Some buyers think Incoterms cover everything in a transaction.

Reality: Incoterms only define delivery obligations, risk transfer, and transport responsibilities. They do not specify product quality, payment terms, inspection rights, or penalties for delays.

Example: A buyer uses CIF in the sales contract but does not clarify quality inspection terms. When the shipment arrives damaged, the seller claims compliance because delivery and insurance obligations were technically fulfilled.

Tip for Buyers: Always supplement Incoterms with a detailed sales contract covering product specifications, inspection, warranties, and payment conditions.

6.2 Choosing the Wrong Term for the Transport Mode

Mistake: Using sea-only terms like FOB or CIF for shipments moved by air, rail, or truck.

Risk: This creates gaps in legal interpretation and may invalidate insurance or carrier responsibilities.

Example: A buyer in Germany asks a supplier in China to ship small parcels by air under FOB. Since FOB applies only to sea freight, the carrier refused to issue the expected Bill of Lading, complicating customs clearance and bank financing.

Tip for Buyers: Use:

FOB, CIF, CFR, FAS → Sea freight only

FCA, CPT, CIP, DAP, DPU, DDP → Air, rail, road, multimodal

6.3 Ignoring Customs Clearance Responsibilities

Mistake: Assuming the seller will handle export and import clearance regardless of the Incoterm.

Risk: Goods may be stuck at customs, and buyers face unexpected storage, demurrage, or penalty fees.

Example: A U.S. buyer used EXW (Ex Works) without arranging an export license in China. The goods sat at the factory for weeks, and the buyer incurred heavy delays and extra costs.

Tip for Buyers: Always confirm who is responsible for customs documentation. If your company lacks local expertise, avoid EXW and prefer DAP or DDP, where the seller takes on more responsibility.

6.4 Overestimating Seller’s Insurance Coverage

Mistake: Believing that insurance under CIF or CIP protects against all risks.

Reality:

- CIF → only requires minimum insurance (Institute Cargo Clauses C), covering very limited risks.

- CIP → requires all-risk insurance (Institute Cargo Clauses A), but still excludes some risks (e.g., war, strikes, delay-related losses).

Example: A buyer of fragile glassware accepted CIF, but when part of the cargo broke due to rough handling, the insurer refused to cover because the minimum coverage did not include breakage.

Tip for Buyers: For high-value or fragile goods, either:

- Request upgraded insurance from the seller, or

- Purchase your own cargo insurance to ensure full coverage.

6.5 Not Aligning Incoterms with Payment Methods

Mistake: Choosing an Incoterm that doesn’t fit your payment arrangement.

Risk: Banks may reject shipping documents, causing financing delays or non-payment.

Example: A buyer used FCA with a Letter of Credit requiring an on-board Bill of Lading. Since FCA typically issues a Waybill instead, the bank refused payment until extra arrangements were made.

Tip for Buyers:

- For Letters of Credit, use FOB or FCA (with Bill of Lading agreement under Incoterms 2020).

- For open account payments, DAP or DDP may be more convenient since the seller arranges full delivery.

- Always check with your banking partner before finalizing the Incoterm.

Conclusion

The latest version of the Incoterms® 2020 rules is now published by the International Chamber of Commerce (ICC) and is protected by copyright. The revised rules reflect the latest developments in commercial transactions. As of January 1, 2020, all sales contracts should include references to the Incoterms® 2020 rules. You can obtain the full rules by visiting the ICC website for official guidance.

If you have any questions about Incoterms® 2020 or international sourcing, we invite you to visit our website cngreentime.com or contact our professional team directly. We will provide tailored solutions based on your specific needs to help you succeed in global sourcing.

Tennie Chen is responsible for sourcing and supplier evaluation, with a focus on balancing product quality, cost efficiency, and supply chain reliability. My role involves identifying trustworthy manufacturers, comparing quotations, analyzing total landed costs, and ensuring compliance with international standards. I always prioritize long-term partnerships over one-time deals, aiming to work with suppliers who can provide consistent quality, competitive pricing, and flexible solutions. When making purchasing decisions, I evaluate not only the product itself but also the supplier’s production capacity, lead time, and after-sales support, ensuring that every cooperation contributes to sustainable business growth.